Fact Check: Zillow’s “87% of DFW Homes Lost Value” Headline Is Misleading

Every year around this time, I start getting the same question:

“Chandler… is the market crashing?”

Recently, a headline from Zillow spread like wildfire claiming:

“Nearly 87% of DFW homes lost value this year.”

I don’t blame anyone for feeling alarmed. Misleading headlines like this are engineered to get clicks.

Before anyone panics, let’s slow down, take a breath, and look at what’s actually happening in the Dallas, Fort Worth real estate market.

This fact check is based on the gold standard of data... verified NTREIS MLS data, not algorithms or estimates.

Table of Contents

-

Zillow’s Claim: “87% of DFW Homes Lost Value”

-

Why Zillow’s Conclusion Is Misleading

-

What NTREIS Real MLS Data Actually Shows

-

What This Means for Your Home Value

-

Zillow’s Claims vs. Real Local Data

-

Final Thoughts

1. Zillow’s Claim: “87% of DFW Homes Lost Value”

Here’s the exact statement that media outlets picked up:

“Nearly 87% of DFW homes lost value this year, according to a Zillow study.”

Immediately after that, the article shifts to a national stat:

These numbers aren’t even measuring the same thing. They switch between DFW metrics and national metrics, creating confusion.

Then the article says:

“An increasing number of homes are selling for less than their purchase price.”

But again, no context:

- Just because its increasing doesn't mean its a majority or even a significant percentage. It just points toward a trendline, thats it.

-

How many homes?

-

Over what time period?

-

In which neighborhoods?

Next comes the key detail: Zillow’s “value loss” is based on the Zestimate, their automated guess of a home’s value.

And that’s the root of the problem.

2. Why Zillow’s Headline Is Misleading (or Just Wrong)

A. Texas Is a Non-Disclosure State

This is important:

Texas does NOT publicly release home sale prices.

So what is Zillow basing its headline on?

By Zillow's own admission, they base their stats on:

-

Estimates

-

Educated guesses

-

User-submitted data

-

Incomplete public records

-

Algorithmic assumptions

It’s not realiable data.

B. Even Zillow’s Former CEO Admitted Zestimates Are Unreliable

Zillow’s own founder, Spencer Rascoff, famously said:

“The Zestimate is not an appraisal and should not be used as a final valuation.”

His own home sold for 40% less than its Zestimate.

If he couldn’t trust it…

why should you?

C. Zillow Blends Time Periods, Markets & Metrics

In one short article, Zillow jumps between:

-

National numbers

-

DFW numbers

-

Zestimate trends

-

Home sales below purchase price

-

Comparisons to 2012

-

“Trend increases”

None of these measure the same thing.

But when stitched together, they make a dramatic headline.

This is how clickbait works.

3. What NTREIS MLS Data Actually Shows (Using Real Local Numbers)

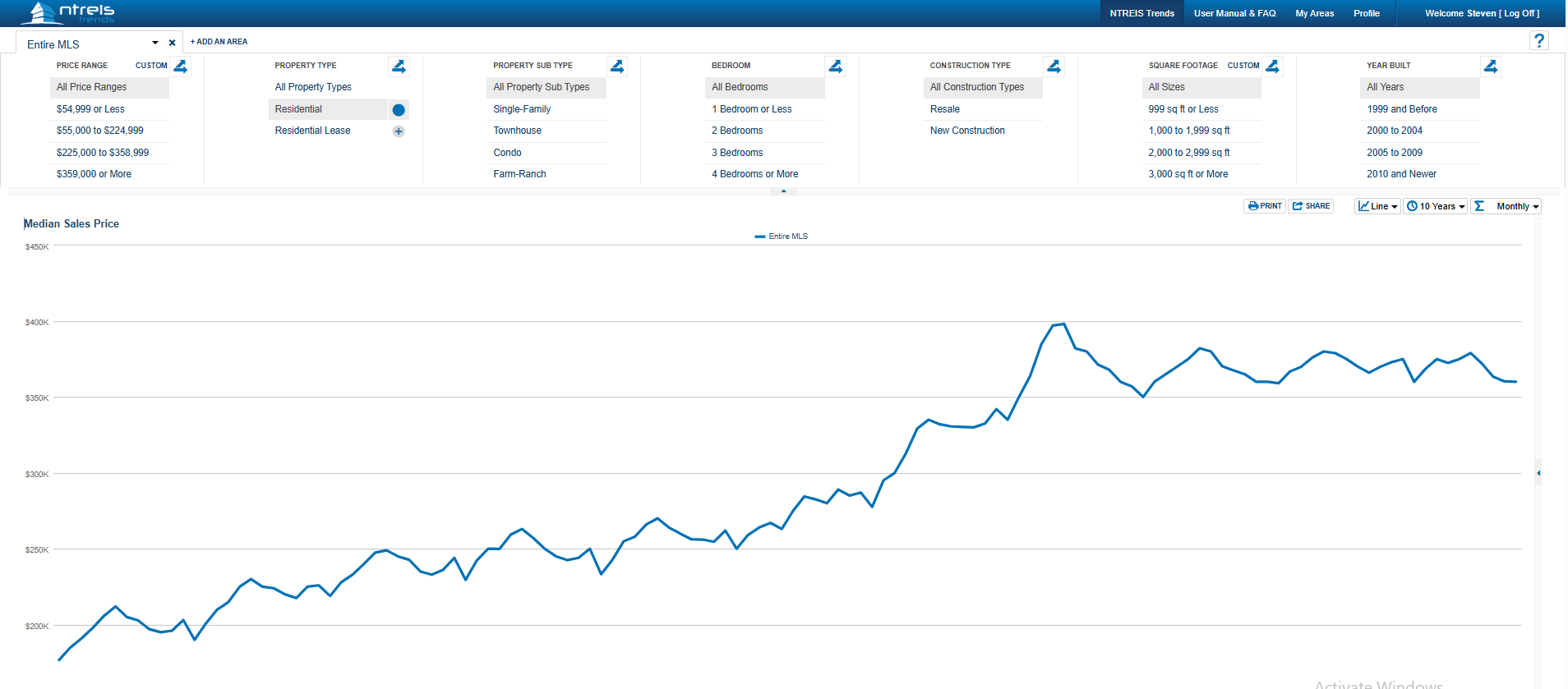

Below is the analysis from NTREIS, the official MLS for North Texas and the only source with verified sold prices.

(Refers to attached chart)

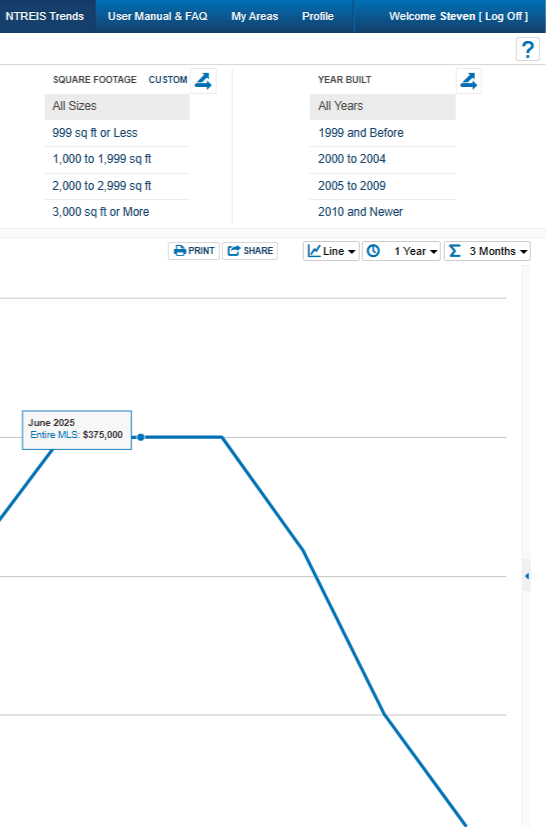

A. Zoomed-In Charts Look More Dramatic

If you only look at data from June 2025 to today, you’ll see:

- Sharp downward slope

-

A dip that looks alarming

-

“Crash-like” visuals

This is the same kind of cherry-picking Zillow is using.

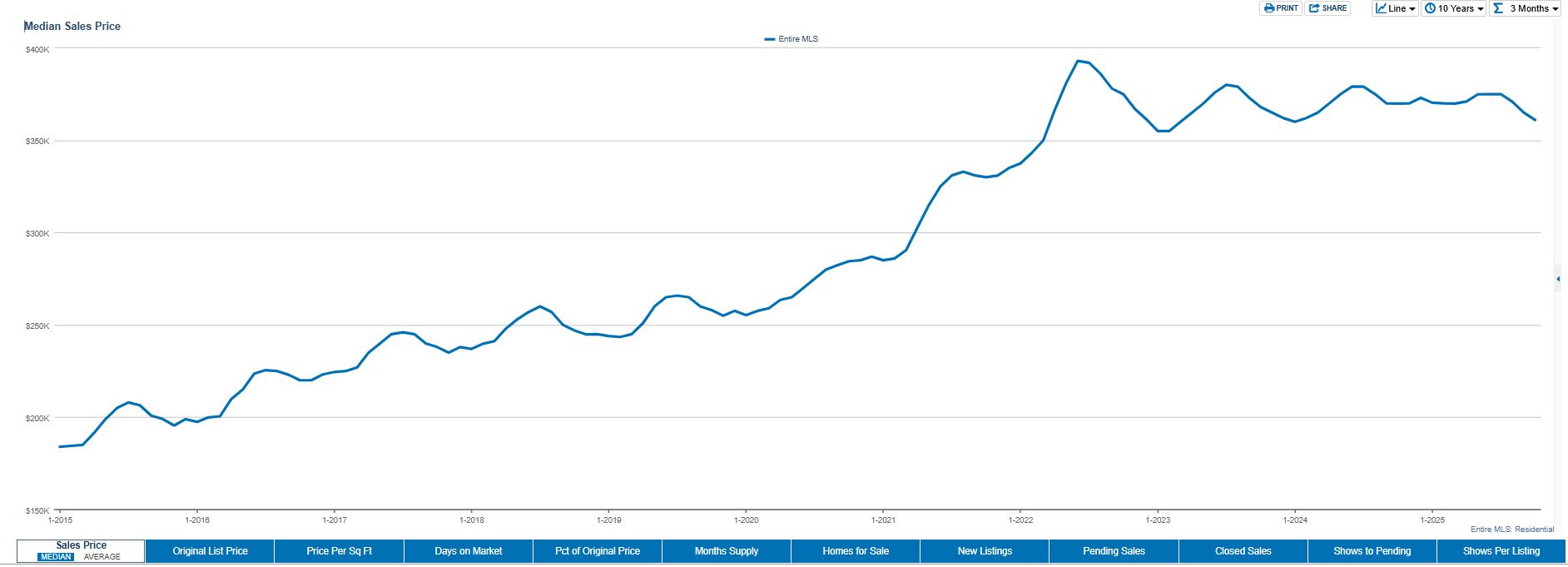

B. Zoom Out Slightly — The Story Changes

Looking at 2022–2025:

-

Yes, prices dipped in 2022

-

But they skyrocketed the year before

-

Net effect = still positive over the multi-year period

C. Zoom Out 10+ Years — The Truth Becomes Clear

Over the past decade:

-

DFW home values show consistent upward growth

-

Seasonal dips appear every year (totally normal)

-

Long-term appreciation has been strong and is leveling off, but we don't see a crash

D. DFW’s Seasonal Pattern Hasn’t Changed

Every single "normal" year we see:

-

↑ Prices in spring/summer

-

↓ Dip in fall/winter

-

↑ Small December bump

-

↓ January drop

-

↑ Climb going into March–June

The only exception?

COVID, which created:

-

Record-low inventory

-

Record-low interest rates

-

Sudden demand surge

-

Then a shock rate spike from 3% → 7%

That distorted the chart briefly.

But the market is now returning to its normal cycle.

E. What’s Really Happening in Today’s DFW Market (Explained Simply)

Here’s what the real NTREIS data shows about the Dallas–Fort Worth housing market right now:

-

Home prices aren’t dropping, they’re pretty steady. The 12 month average (which factors out seasonal changes) shows a slight increase.

-

There are about 5 months of inventory on the market, which means the market isn’t too fast or too slow. It’s balanced.

-

The market is following its normal yearly pattern again, with predictable ups and downs depending on the season.

-

Experts expect home values to go up as much as 4% over the next year, which is healthy, normal growth.

-

DFW is still one of the strongest housing markets in the entire country.

- Statewide projections by one of the most trusted sourcs, TAMU, show an increase as well.

And the most important point:

Did 87% of homes lose value? Not according to a legitimate analysis using actual MLS numbers.

4. So… Is the DFW Market Crashing? (No.)

Here’s the truth:

1. If you bought at the absolute COVID peak:

Yes, you may sell today for slightly less than you paid.

2. If you bought before that peak:

You’re up.

3. If you bought 10+ years ago:

You’re way up.

Here’s the key:

DFW home values today are stable, healthy, and normalizing, not crashing.

There is no 87% loss, no collapse, no crisis.

Just regular seasonal movement that looks scary when stripped of context.

5. Zillow’s Claims vs. Real MLS Data

Zillow Claims:

-

“87% of DFW homes lost value”

-

Based on Zestimates, not sold prices

-

Blended national + local numbers

-

Inconsistent timelines

-

Algorithmic guesses

NTREIS MLS Reality:

-

Verified sales data shows stable values

-

Seasonal dips are normal

-

Long-term appreciation is strong

-

DFW remains a top-performing market

-

No evidence of widespread value loss

Final Thoughts

I know these headlines can be stressful. You trust us to give you the real story, not sensationalism.

So here’s the bottom line:

- The DFW housing market is stable

- Home values are not crashing

- Zillow’s headline is misleading

- Real MLS data tells the true story

If you ever want an accurate, MLS-based valuation of your home, I’m happy to run it for you, no pressure, no sales pitch.

Thanks for reading, and thanks for trusting me with something as important as your home.

— Chandler

Written by Chandler Crouch

Broker/Owner at Chandler Crouch Realtors

See more media features on our News page

Categories

- All Blogs (118)

- Basics (17)

- Buyer Psychology (3)

- Career (1)

- CCR in the News (14)

- Community (22)

- Downsizing (3)

- Election (6)

- Financial Advice (14)

- Foreclosure (1)

- Heritage Subdivision (3)

- Home Refinancing (4)

- Home Search (2)

- How-to (22)

- HUD Homes (2)

- Just for fun (10)

- Legislative Involvement (5)

- Making an offer (5)

- Mortgage (2)

- Negotation (4)

- Preparing to Sell (10)

- Print media (3)

- Property Tax (53)

- Real Estate Market Report (26)

- Robert Montoya (1)

- Sell (1)

- Senior Housing (1)

- State (4)

- Static (1)

- TAD Reform (8)

- Tarrant County (14)

- Testifying (2)

Recent Posts