51 Percent of Tarrant County Seniors Pay $0 School Property Tax

More than half of Tarrant County seniors said goodbye to their school taxes after Texas lawmakers supercharged their homestead and over 65 exemptions.

An analysis of 2025 exemption data from the Tarrant County Appraisal District shows the tax breaks have slashed school tax bills for 127,182 senior households. One of the biggest takeways is that 51 percent saw their school taxes eliminated, while nearly 30 percent pay less than $1,000. This study only compared the data for school districts that do not overlap with an adjacent county: Arlington ISD, Birdville ISD, Everman ISD, Fort Worth ISD, Keller ISD, Mansfield ISD, Lake Worth ISD, Crowley ISD.

If you're wondering why you're still paying a school tax bill after hearing about all of the hype, take a look at your home's value. You'll see that school districts with lower median property values have the highest percentage of seniors who no longer pay school taxes.

The combined Homestead and Over 65 exemptions, which were approved by Texas voters in November, reduce the taxable value by $200,000.

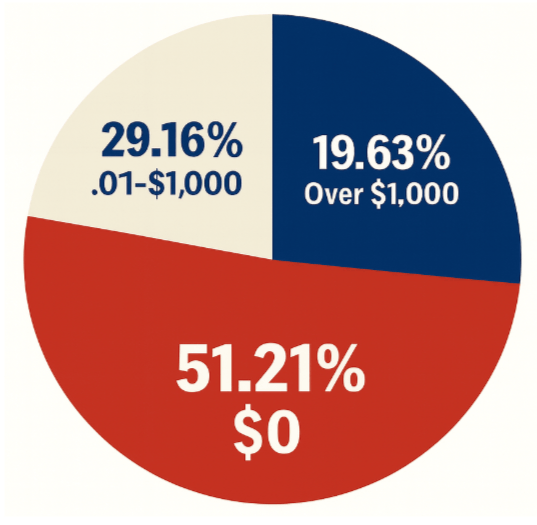

Countywide Overview of Senior Tax Liability

Across all districts included in the study, senior households fall into three groups:

- 51.21% pay $0 school district taxes

- 29.16% pay between 1 cent and $1,000 per year

- 19.63% percent pay more than $1,000 per year

In other words, about four out of every five senior homeowners now pay $1,000 or less in school taxes each year.

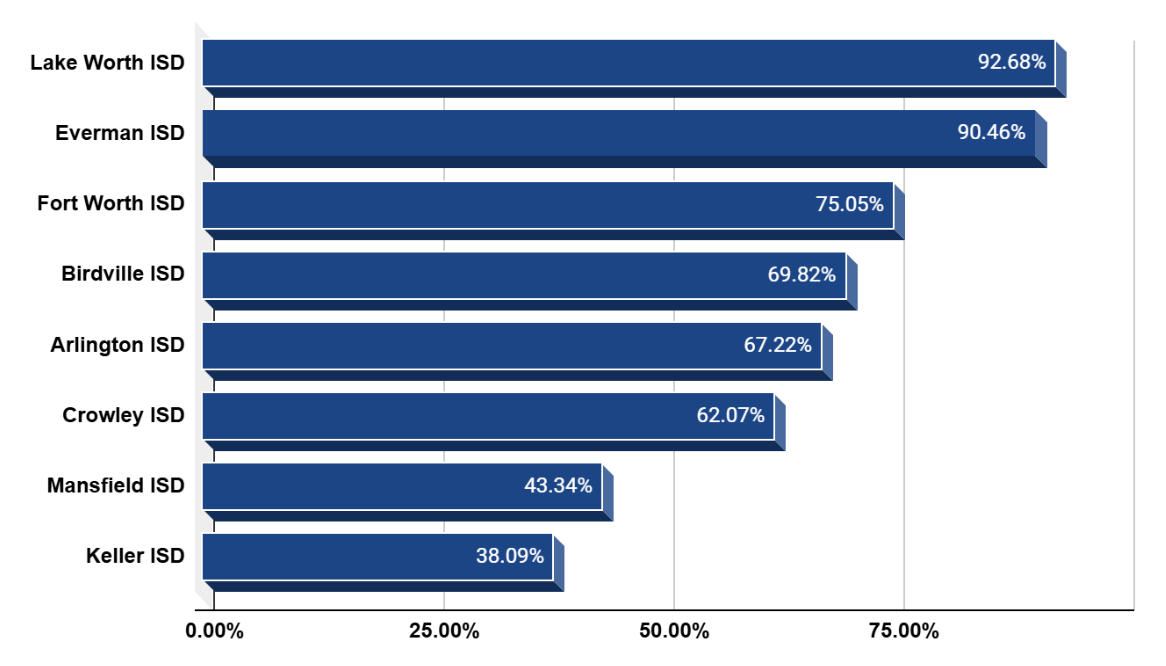

Breaking Down the Numbers by School District

The following graph shows how many households with an over 65 exemption pay $0 school tax.

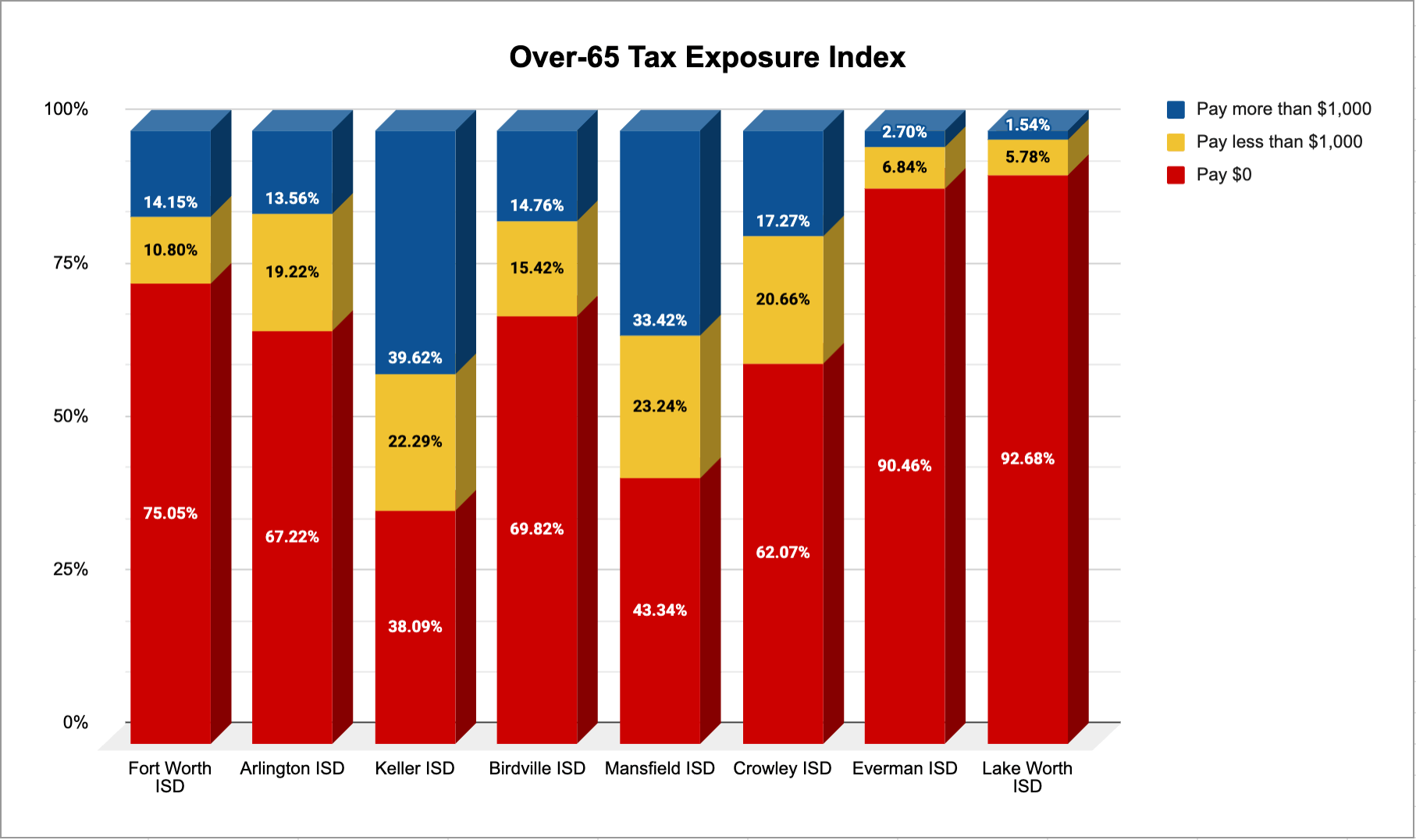

Over-65 Tax Exposure Index: How Much Seniors Actually Pay

This graph breaks senior property owners into three groups:

- Seniors paying $0

- Seniors paying between 1 cent and $1,000

- Seniors paying more than $1,000

2025 Median Property Values by District

The median value is used because it's not affected by extreme highs or lows. It reflects the middle of the market.

Lake Worth ISD

Median: $285,000

Everman ISD

Median: $269,999

Fort Worth ISD

Median: $307,750

Birdville ISD

Median: $330,000

Arlington ISD

Median: $315,000

Crowley ISD

Median: $325,000

Mansfield ISD

Median: $429,219

Keller ISD

Median: $407,000

Data Sources

- All tax data in this report comes directly from public records

- Tarrant Appraisal District (TAD) – Ownership, appraisal values, and exemption data

https://www.tad.org/resources/data-downloads - Tarrant County Tax Assessor–Collector – Certified tax roll, levy amounts, and actual tax due

https://www.tarrantcountytx.gov/en/tax/property-tax/tarrant-county-tax-roll.html - Sales data comes from ntreis.net

Study Scope and Districts Included

- To avoid cross-county distortion, this study includes only school districts entirely within Tarrant County:

- Arlington ISD, Birdville ISD, Everman ISD, Fort Worth ISD, Keller ISD, Mansfield ISD, Lake Worth ISD, Crowley ISD

- Excluded districts cross county lines, including Grapevine-Colleyville, Northwest, Kennedale, Aledo, Burleson, Lewisville and others.

- Only residential properties were analyzed, and all values reflect 2025 certified levy amounts after exemptions and senior freezes.

Categories

- All Blogs (120)

- Basics (17)

- Buyer Psychology (3)

- Career (1)

- CCR in the News (14)

- Community (23)

- Downsizing (3)

- Election (6)

- Financial Advice (14)

- Foreclosure (1)

- Heritage Subdivision (3)

- Home Refinancing (4)

- Home Search (2)

- How-to (22)

- HUD Homes (2)

- Just for fun (10)

- Legislative Involvement (6)

- Making an offer (5)

- Mortgage (2)

- Negotation (4)

- Preparing to Sell (10)

- Print media (3)

- Property Tax (53)

- Real Estate Market Report (26)

- Robert Montoya (1)

- Sell (1)

- Senior Housing (1)

- State (5)

- Static (1)

- TAD Reform (8)

- Tarrant County (15)

- Testifying (2)

Recent Posts